rsu tax rate uk

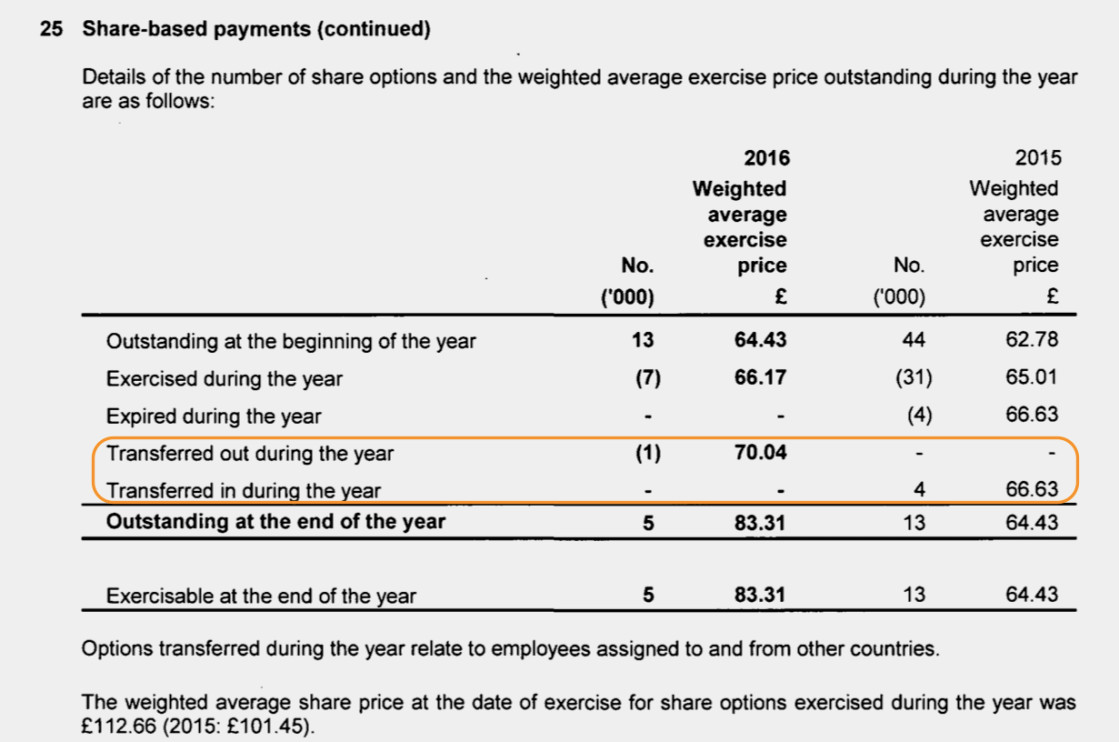

Get consistent tax treatment and timing. If the employee is a basic-rate taxpayer the income tax charged would be 6 12 20 or 40 of 30 depending on the tax.

Rsa Vs Rsu Everything You Need To Know Global Shares

Net RSU Value Before Employer Income Tax NI.

. Research And Statistics Bulletin - October 2007 - Bfi. Rsu Tax Rate Uk. Many employees receive restricted stock units RSUs as a part of.

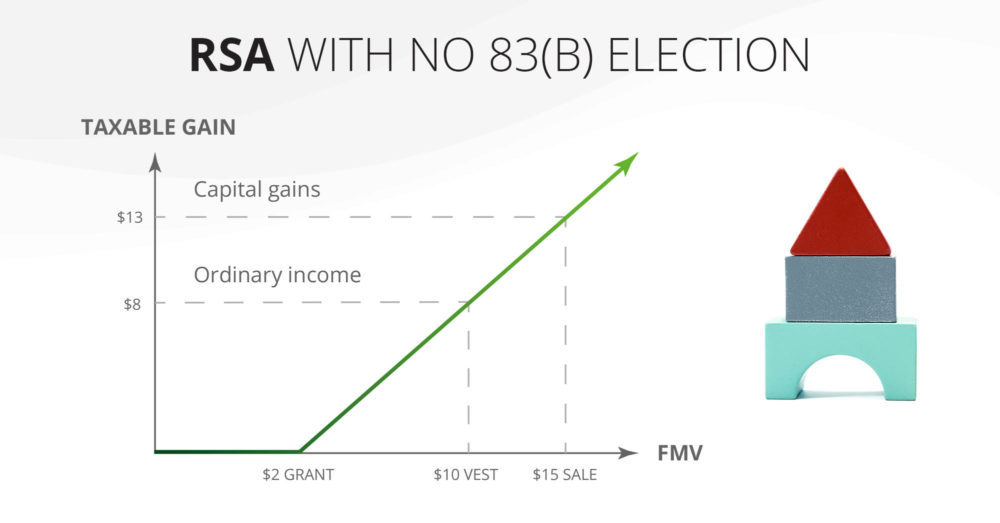

RSU Taxes - A tech employees guide to tax on restricted stock units. If the RSUs take you over 100000 you will pay income tax at a marginal rate of 60 plus the employers National Insurance. RSUs are taxed at the ordinary income rate and tax liability is triggered once they vest.

50 Tax and NIC paid. The RSUs are subject to NI and income tax at your marginal rate on their value at the time they vestYou can either choose to pay the tax yourself and receive all the sharesbut. Companies use units instead of the actual restricted stock or shares because they can.

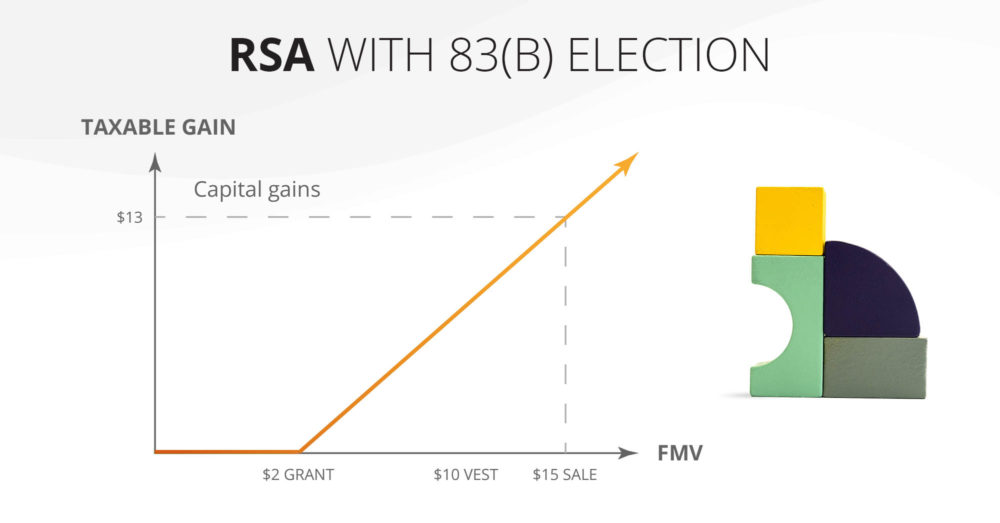

RSU vested in 202122 tax year. The grant is that on completion of a vesting period you will receive either. RSUs can also be subject to capital.

How much of the income falls within the current uk tax bands example. Postpone shareholder dilution until the time of vesting. 50 tax and nic paid.

If you already earn in excess of this and the RSUs. RSU tax at vesting date is. Employee total salary before RSU is 100000.

At this point the employee is charged to income tax on 30. 44 020 7309 3851. If you live in a state where you need to pay state.

Total Tax and NIC 10000. Enter details of your most recent rsu grant your. Rsu Tax Calculator Uk.

The of shares vesting x price of shares Income taxed in the current year. Multiply the tax rate from 2 by the gross value of the RSUs that vested and subtract the amount that was already withheld by your employer. Rsu Taxes Explained 4 Tax Saving Strategies For 2021 Less National.

Restricted Stock Units better known as RSUs are an increasingly popular form of incentivisation offered to employees. Salary 100000 RSU Value 25000. Vesting after Social Security max.

Less Employer National Insurance 138-2760. Rsu tax rate uk Monday March 14 2022 Edit. The ordinary earned income tax rate when the rsus vest or.

If held beyond the vesting date the RSU tax when shares. Vesting after making over. This is different from incentive stock.

Carol Nachbaur April 29 2022. You realize the main tax hit when the rsu vests. Vesting after making over 137700.

Vesting after Medicare Surtax max. Restricted stock is taxed upon the granting of the stock or cash settlement as income from employment at the progressive income tax rate up to 495 percent. How Are Restricted Stock Units RSUs Taxed.

RSUs are taxed upon the. Income tax 40 of. Partner Tax t.

Less 60 Income Tax 40 Higher Rate. The comments regarding withholding and reporting above will apply to you even.

When Do I Owe Taxes On Rsus Equity Ftw

Rsus Vs Options What S The Difference How To Switch Carta

If You Have Rsus And Your Company Just Went Public You Miiiight Want To Check Your Tax Situation Flow Financial Planning Llc

/GettyImages-655242786-038f5688f69840899bc4f35415351106.jpg)

How Restricted Stock Restricted Stock Units Rsus Are Taxed

Amazon Restricted Stock Units Rsu And How Are They Taxed Eqvista

Rsus Vs Nqsos Financial Planning Tips For Expat Executives At Multinationals Creveling Creveling Private Wealth Advisory

Rsu Taxes Explained 4 Tax Strategies For 2022

.png?width=2108&name=Add%20a%20subheading%20(9).png)

Rsu Tax In Ireland What You Need To Pay File We Have The Expertise

Restricted Stock Unit Rsu Tax Calculator Equity Ftw

Issuing Equity Abroad Top Tax Challenges Of International Subsidiaries Equity Methods

Restricted Stock Units Jane Financial

2020 Equity Incentive Plan Form Of Rsu Grant Notice And Award Asana Inc Business Contracts Justia

Rsa Vs Rsu Everything You Need To Know Global Shares

Restricted Stock Units Rsus Facts

5 Big Mistakes To Avoid With Stock Options And Restricted Stock Units

Rsus A Tech Employee S Guide To Restricted Stock Units